Additionally, capital-intensive industries, such as manufacturing, typically finance expensive equipment with debt, which leads to higher gearing ratios. There are many types of gearing ratios, but a common one to use is the debt-to-equity ratio. To calculate it, you add up the long-term and short-term debt and divide it by the shareholder equity. If you don’t have any shareholders, then you (the owner) are the only shareholder, and the equity in this equation is yours.

Reduce Working Capital

The optimal debt-to-equity structure is a factor of many things, including the firm’s weighted average cost of capital, the cost of equity, and the cost of debt that the company has. It is mainly because it tells about how much the company relies on debt versus the equity they have raised over time. It shows that a business is fiscally prudent and consistently aims to finance its operations in a way that strikes a good balance between debt and shareholder equity. A crucial tool for businesses to consider when organizing their capital structure.

Return On Assets Analysis: Interpret, Definition, Using, and more

This ratio can be used by a business to evaluate the effects of issuing more shares or taking on more debt. An essential statistic used by creditors and lenders to assess a company’s creditworthiness is the gearing ratio. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Reduce Costs

Gearing (otherwise known as “leverage”) measures the proportion of assets invested in a business that are financed by long-term borrowing. However, it focuses on the long-term financial stability of a business. Three ratios used in the financial analysis include profitability, liquidity, and gearing.

Gearing Ratios: What Is a Good Ratio, and How to Calculate It

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. On the other hand, even a slight improvement in such a company’s ROCE can lead to a large increase in its ROE. For every $4 contributed by common stockholders, there are only $3 contributed by fixed cost bearing funds. Hence, the capital provided by these two is said to offer a fixed return. In most cases, servicing the debt and paying back the liabilities automatically reduces the company’s liability.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Suppose a company reported the following balance sheet data for fiscal years 2020 and 2021.

- One important financial indicator for assessing a company’s financial health is the gearing ratio.

- If a company were to have a high D/E ratio, the company’s reliance on debt financing to fund its continuing operations is significant.

- For instance, a company with a gearing ratio of 60% could be regarded as high risk when evaluated in isolation.

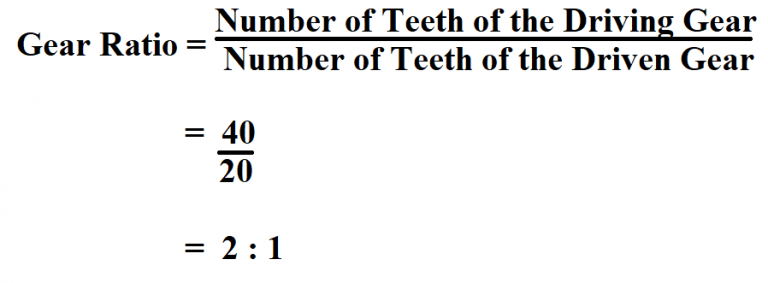

One financial statistic used to assess a company’s level of financial leverage is the net gearing ratio. It contrasts the total amount of debt—which includes bank overdrafts and long—and short-term debt—with the total amount of shareholders’ equity. When gearing ratio is calculated by dividing total debt by total assets, it is also called debt to equity ratio.

High ratios may be a red flag while low ratios generally indicate that a company is low-risk. Capital-intensive companies or those with a lot of fixed assets, like industrials, are likely to have more debt versus companies with fewer fixed assets. For example, utility companies typically have a high, acceptable gearing ratio since the industry is regulated. These companies have a monopoly in their market, which makes their debt less risky companies in a competitive market with the same debt levels.

Put simply, it tells you how much a company’s operations are funded by a form of equity versus debt. Companies took on big debt to buy other firms, boosting their gearing ratios. But after the 2008 financial crisis, the risks of too much debt became clear, and many companies scaled back, focusing on stability. This ratio is very important for investors and financial analysts because how to calculate contribution per unit it offers insights into a company’s capital structure and its reliance on debt financing. This figure alone provides some information as to the company’s financial structure but it’s more meaningful to benchmark it against another company in the same industry. Much depends on the ability of the business to grow profits and generate positive cash flow to service the debt.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Another method to decrease your gearing ratio is to increase your sales in an attempt to increase revenue. You could also try to convince your lenders to convert your debt into shares.

A mature business which produces strong and reliable cash flows can handle a much higher level of gearing than a business where the cash flows are unpredictable and uncertain. Gearing assessment is important in financial analysis because it mainly impacts profitability and liquidity. For instance, profitability is compromised if the business has to incur a higher interest cost.